Investigating the impact of insights with Samsung, GM and Microsoft

Global perspectives on the innovation and elevation of insights with Samsung, General Motors, Microsoft and mTab.

Global perspectives on the innovation and elevation of insights with Samsung, General Motors, Microsoft and mTab.

By Crispin Beale

Earlier this year I had the opportunity to moderate an international panel of research and insight experts for Market Research Society’s Impact 2021 annual conference. This panel included expert perspectives on an array of topics around the strength role and value of market research from:

Ed Clarke, Market Research Director, Corporate Insights for Microsoft in the United States

Justine Clements, Consumer Insights Manager, Samsung Electronics in Australia

Arturo Encinas, Director of China Market Research & Forecasting, General Motors

Shirley Ng, Research Principal, International Research & Consumer Insights, GM in China

The following is a follow-up on a selection of other key topics that I thought would be of interest to fellow research and insight professionals.

Speed vs. Accuracy

Crispin: With markets quickly evolving, how do you balance the need for both speed and accuracy within research?

Justine: “With the availability of faster research methodologies, more stakeholders expect faster outcomes – but good research - research that answers complex questions - those that need deep understanding and analysis, and quality recommendations still take time.

“In terms of accuracy, this includes the quality of the data. Yes it can be collected quickly, albeit stringent quality controls and piloting can increase the time taken to collect data. The analysis - a lot of data can be analyzed very quickly by a machine and given the right parameters the accuracy can be very high, people are slower and may at times also be inaccurate - and the recommendations, with skill and experience recommendations can be delivered more quickly, but thinking time.”

Ed: During my Starbucks days I always said you never want to be a speed bump to the business; you have to answer questions at the rate the business needs it. If the answer comes after the decision is made then the research was conducted for not. Beyond this, many people often look for precision when precision isn’t needed.

Having said this, a wrong answer is often worse than no answer. Assuming you have a high-functioning research team, be willing to push back if the business owner doesn’t provide adequate time. It’s a balance.”

Shirley: “It is not a trade-off. We want both speed and accuracy. New technology can help address a quicker turnaround for results. As curious researchers dealing with faster changing trends in an industry that is by default “slower” in product development, it takes a lot longer to put a new car or truck out on the road.

“Budget management also forces us to look for new research approaches, and we do spend time listening to new and innovative practices externally. We revisit our own methodologies often. Ultimately, at our company, accuracy of data is non-negotiable.”

Brand Measurement

Crispin: How is brand trust effectively measured today?

Justine: “The importance of trust to brands in our category is vital. Samsung measures trust directly with customers who have any interactions with Samsung, as well as indirectly given the importance of perceptions of trust, as fewer consumers have direct experiences with the organization.

“We also measure trust in a way that is relative and category agnostic against global brands to determine our overall perceived trust. Category specific trust is underpinned by reliability and/or product quality and customer service/after sales service. Mostly this is relative to our direct competitors with the bar for service in particular constantly changing for the better. Like many things we measure, trust is not static, nor is it objective - it relies on what people value and or expect, and that changes over time.”

Arturo: “In the automotive world trust is developed over time and remains in the subconscious of our customer as they make decisions. Measuring brand trust could be done with very specific KPIs such as quality problems per thousand, which is connected with a quantitative tracking mechanism that investigates “a brand I can trust” over time.

“As a last step, qualitative discussions including psychographics to split groups incorporating the trust component. Ultimately, there is no straight single approach, but rather a comprehensive methodology with all these steps.”

Crispin: Ed, I wanted to ask you how you facilitate driving action with research rather than just reporting findings?

Ed: “We really focus on understanding our internal stakeholders’s business, so we have a strong business acumen. This allows us to connect the dots that others don’t or that our stakeholders can’t. We often develop a portfolio of recommendations like McKinsey would. We also work with our stakeholders through solutioning sessions and try to get commitments up front with our engagements.”

Research Challenges

Crispin: What do you see as the biggest challenge to research appearing on the horizon?

Ed: “There are a couple of things; people thinking they can answer every question with behavior or telemetry-based data. Aside from this, people not being skilled enough to provide value to research - everyone thinks they are an expert in research.”

Justine: “Lack of senior, qualified, experienced professionals in the industry - we aren’t making it attractive to bring new people to the industry or retain them once we have them trained.

“The role of technology vs. human – technology can provide access to more data, help us manage volumes of data, but it still comes down to a person creating a model or framework to guide the task of analysis or interpretation. Also, loss of time to manage large volumes of data – thinking about the speed and volume we are going to have to manage in future. My concern is our focus will shift to managing data and away from thinking about insights.”

Shirley: “Looking forward instead of confirmation of the present. GM is spending a lot more time investigating new potentials rather than confirmation of the present. But we have to be careful about making a call on certain decisions internally about the future.

“Auto manufacturing and market research are not a likely combination that attracts new blood. Interim staff traffic in our team is expected, but allowed in our department. For an industry that requires a longer training period that is tough on team leaders.

“How data is generally used worries me a lot. Data variety and velocity often drives ambiguous conclusions. I also do not like seeing the human brain’s ability to derive in depth insights using current data and past experiences to be overshadowed by the excitement of new tech.”

Crispin: Thank you to Shirley, Ed, Arturo and Justine, it was fascinating talking to you and getting a truly global perspective on these issues.

You can watch the original panel discussion from the MRS 2021 Impact Conference below:

WATCH: Impact 2021 International Panel

MRS are now planning for the March 2022 MRS Conference “Reinvention and Growth” if you want to take part click on this link:

https://www.mrs.org.uk/event/call-for-contributions/call-for-contributions-impact-2022

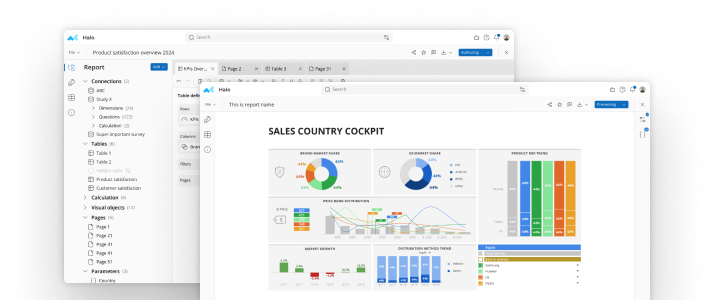

Make smarter decisions faster with the world's #1 Insight Management System.